Research how to get your tax number from the South African Revenue Service (SARS).

There are two categories of taxpayers: residents and non-residents.

The government taxes residents depending on their worldwide income and non-residents based on their South African income.

Photo: canva.com (modified by author)Source: UGC

SARS uses your tax number to track your Income Duty payment progress and other related information.

Continue paying your levies as you look for ways to stop corruption in the government.

Read on to learn how to get your Personal Income Duty number.

Read also

How do I register as a taxpayer in South Africa?

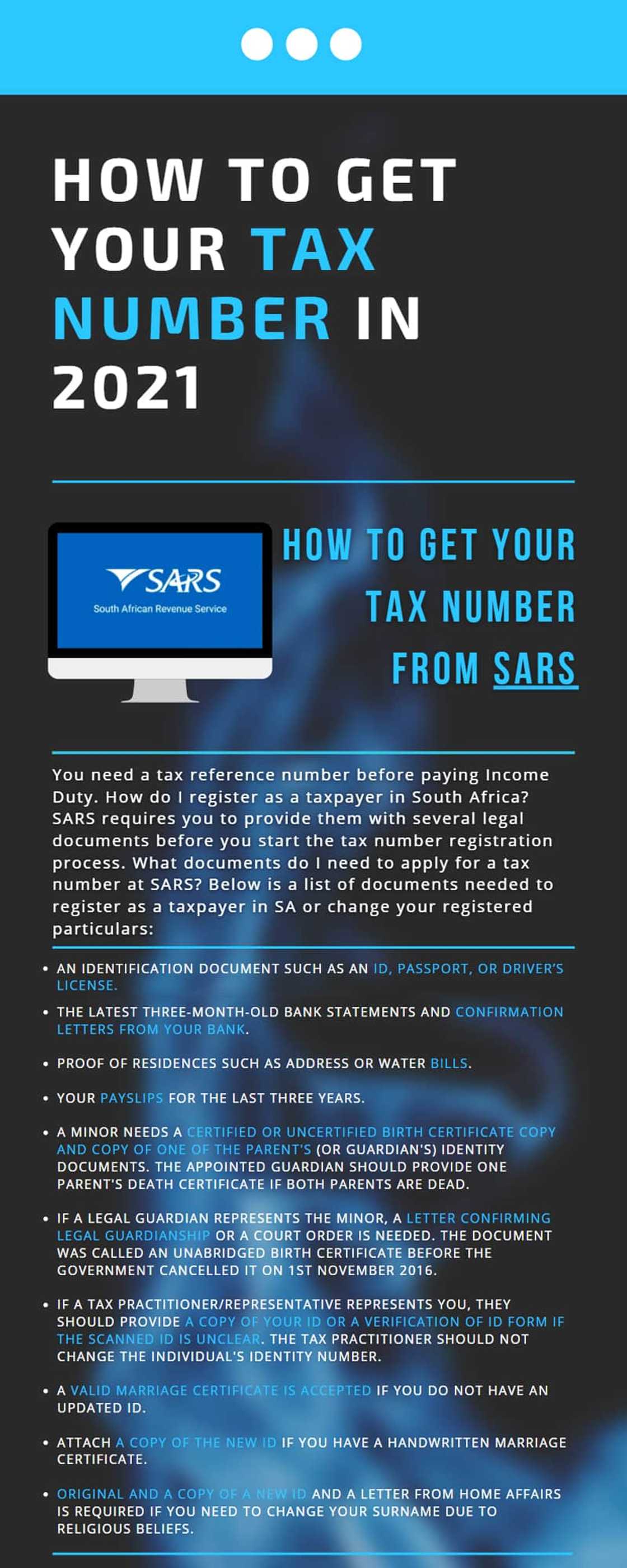

SARS requires you to provide them with several legal documents before you dive in the tax number registration process.

What documents do I need to apply for a tax number at SARS?

Read also

Meanwhile, a company can apply using the tax number form IT77C.

File your Income Duty online viathe eFiling platform.

Do not leave the office without the new number.

Read also

Ask the SARS employees details abouteFillingand other Income Duty-related issues.

You are probably done registering but wondering, “how do I get my tax reference number?”

SARS will post a letter containing your 10-digit Income Duty number later, mostly within 21 days after registration.

South African residents and non-residents pay income duty. Photo: @iridiumbusinessSource: Twitter

The SARS letter is a form of an IT150/Notification of registration.

What happens if Iforget my tax number?

So, where do you find your Income Duty reference number when you find yourself in this situation?

Read also

SARS does not require an individual to have an Income Duty number when employed for the first time.

Check your IRP5 or payslip from your employer, as your Income Duty reference number may appear there.

Some of these circumstances include:

You are now familiar with how to get your tax number.

Read also

Is there no excuse not to have it?

just note that the state treats not having a tax number as a crime.

Mzansi’s mass media often enlightens people about this.

Evading from paying Income Duty is a crime. Photo: @iridiumbusinessSource: Twitter

DISCLAIMER:This article is intended for general informational purposes only and does not address individual circumstances.

Any action you take upon the information presented in this article is strictly at your own risk and responsibility!

When did tax start in South Africa?

Read also

The history of tax is traceable over a century ago.

The government exempts some people are excepted from somelevies.

South Africa is among the world’s fastest developing countries.

Do you want to slow down your country’s progress?

If not, then pay levies.

It is not easy to pay levies, but your country needs you as much as you need it.

Source: Briefly News

Jedidah TabaliaJedi is a journalist with over 5 years working experience in the media industry.

She has a BSc.

She loves traveling and checking out new restaurants.

Her email address is jedidahtabalia@gmail.com