The government of South Africa collects various taxes, and Value Added Tax (VAT) is among them.

This tax is levied on goods and services.

We have you covered if you wish to learn how to calculate VAT.

Photo: canva.com (modified by author)Source: UGC

Many people want to learn how to calculate VAT.

This tax is normally charged at a given percentage.

Every South African resident or citizen pays VAT whenever they purchase products or services in the country.

Read also

Other nations besides SouthAfricaalso pay this tax.

Value Added Tax was first introducedin South Africaon 29th September 1991 at a rate of 10%.

The percentage has since increased to 15%.

Read also

The final price of a product or service includes the VAT payable.

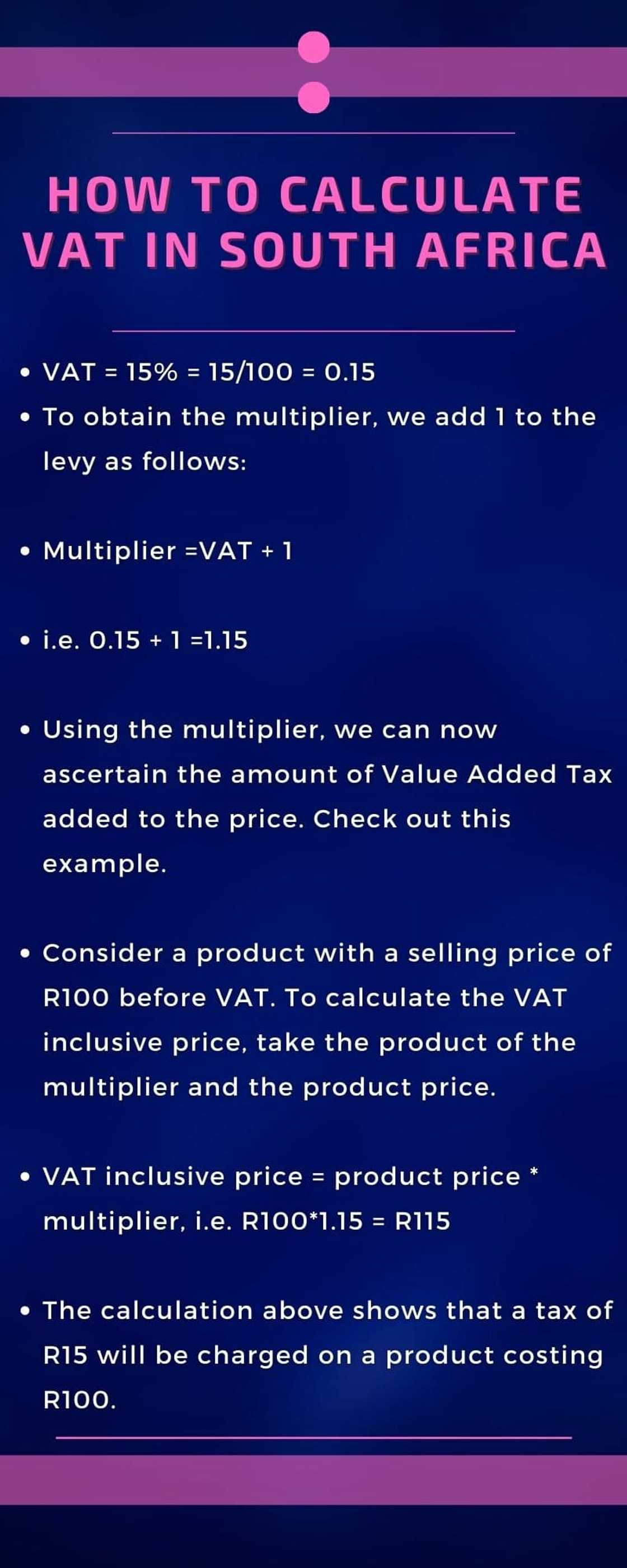

Knowing the multiplier is the first step.

Currently, Value Added Tax in South Africa stands at 15%.

A an animated picture of someone filing their tax returns. Photo: pixabay.com, mohamed_hassanSource: UGC

Below is a simple yet comprehensive guide on completing the calculation.

Check out this example.

The South African Revenue Service paysrefundable VATto a vendor who paid their VAT fee in excess.

Read also

Calculating the VAT exclusive price is possible if you have the VAT inclusive price.

you oughta know the divisor to complete the calculation.

Below is a quick guide to help you compute the divisor using the fee rate.

Read also

you’ve got the option to use a taxcalculator in SAto know the tax inclusive and exclusive prices.

There are different online calculators you’re free to use.

Online calculators are easy to use.

A picture of a calculator. Photo: pixabay.com, @Peggy_MarcoSource: Facebook

How much is VAT in South Africa in 2022?

Starting 1st April 2018, the standard VAT rate has been 15%.

Only afew selectproducts and services are subject to 0% VAT.

Read also

What is the formula for calculating VAT in South Africa?

VAT is calculated by multiplying the VAT rate of 15% in South Africa by the total pre-tax cost.

The cost of VAT is then added to the purchase.

Read also

The easiest way is to use an online calculator.

Before using any site, confirm its reliability.

What is the VAT rate in South Africa in 2022?

The current rate is 15%.

This rate was effected on 29th September 1991.

How does the VAT system work in South Africa?

TheValue Added Taxsystem is designed to be paid mainly by the ultimate consumer or purchaser in South Africa.

It is levied at a standard rate of 15% or a 0% for select dates.

What is VAT output?

This isthe VATthat is calculated and charged on the sale of goods and services from businesses that are VAT-registered.

What is input VAT?

Input VAT isthe taxincluded in the price when you purchase taxable goods or services for yourbusiness.

All businesses should learn how to calculate input and output VAT in South Africa.

you might calculate your VAT manually, using Excel, or an online calculator.

There are two categories of taxpayers: residents and non-residents.

The government levies taxes on residents based on their worldwide income and non-residents based on their South African income.

SARS uses your tax number to track your Income Duty payment progress and other related information.

Source: Briefly News

Jedidah TabaliaJedi is a journalist with over 5 years working experience in the media industry.

She has a BSc.

She loves traveling and checking out new restaurants.

She holds a Diploma in Mass Communication and a Bachelors degree in Nutrition and Dietetics from Kenyatta University.

Cyprine joined Briefly.co.za in mid-2021, covering multiple topics, including finance, entertainment, sports, and lifestyle.

In 2023, she finished the AFP course on Digital Investigation Techniques.

She received the Writer of the Year awards in 2023 and 2024.

In 2024, she completed the Google News Initiative course.

Email: cyprineapindi@gmail.com